With the helpful app Robinhood, you may purchase and sell stocks without paying a commission. The software also enables after-hours trading in addition to during business hours. You can then take advantage of numerous advantages including more market activity and lower prices. You must enable this function because it isn’t immediately available. This article will go into detail on using Robinhood after hours to buy or sell.

Robinhood Gold: Buying and Selling After Hours

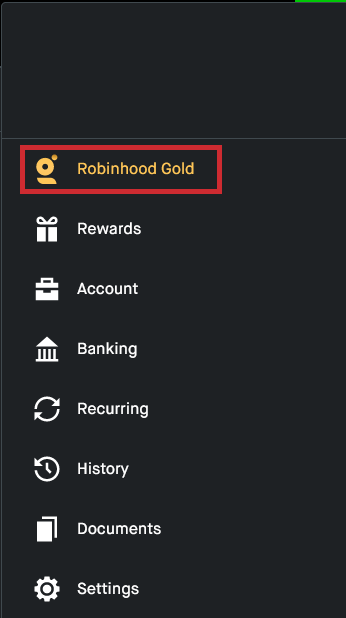

Trading after hours isn’t particularly difficult, but it’s only available to Gold members, so you’ll need to first increase your membership. Here’s how to sign up for the subscription on your phone, which costs $5 per month:

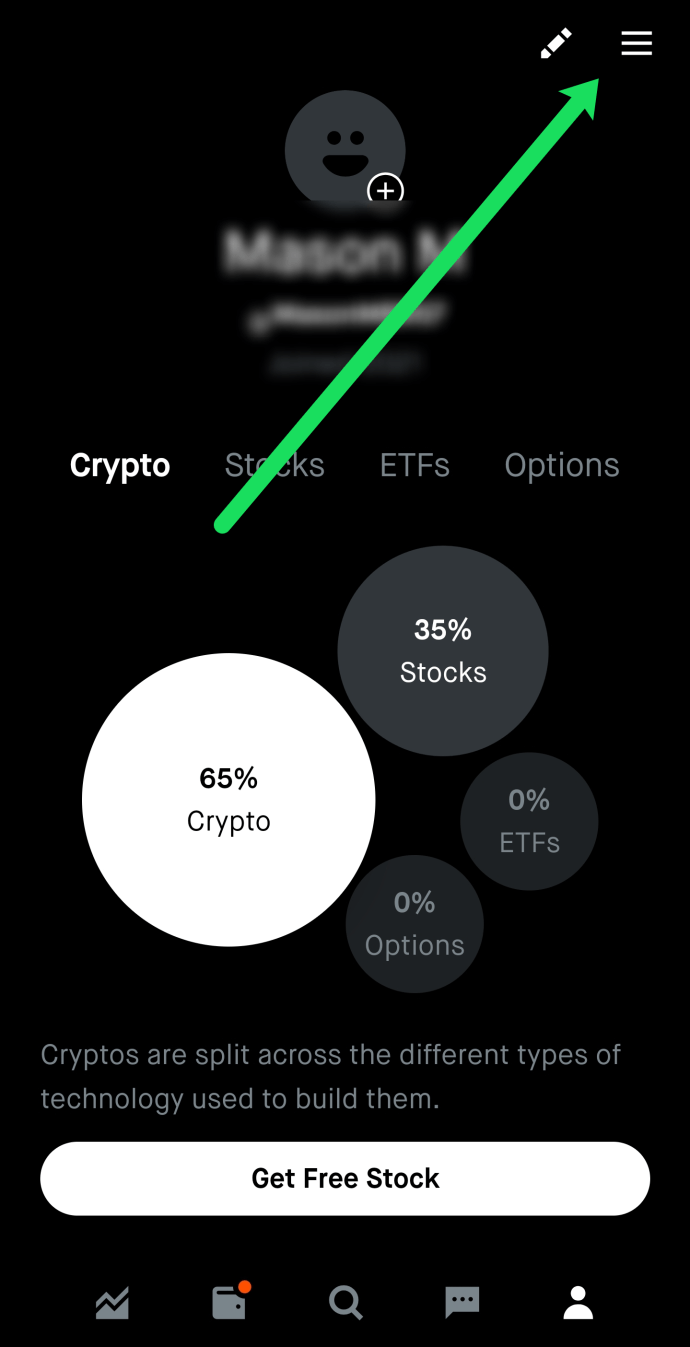

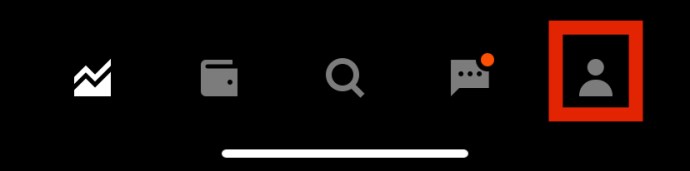

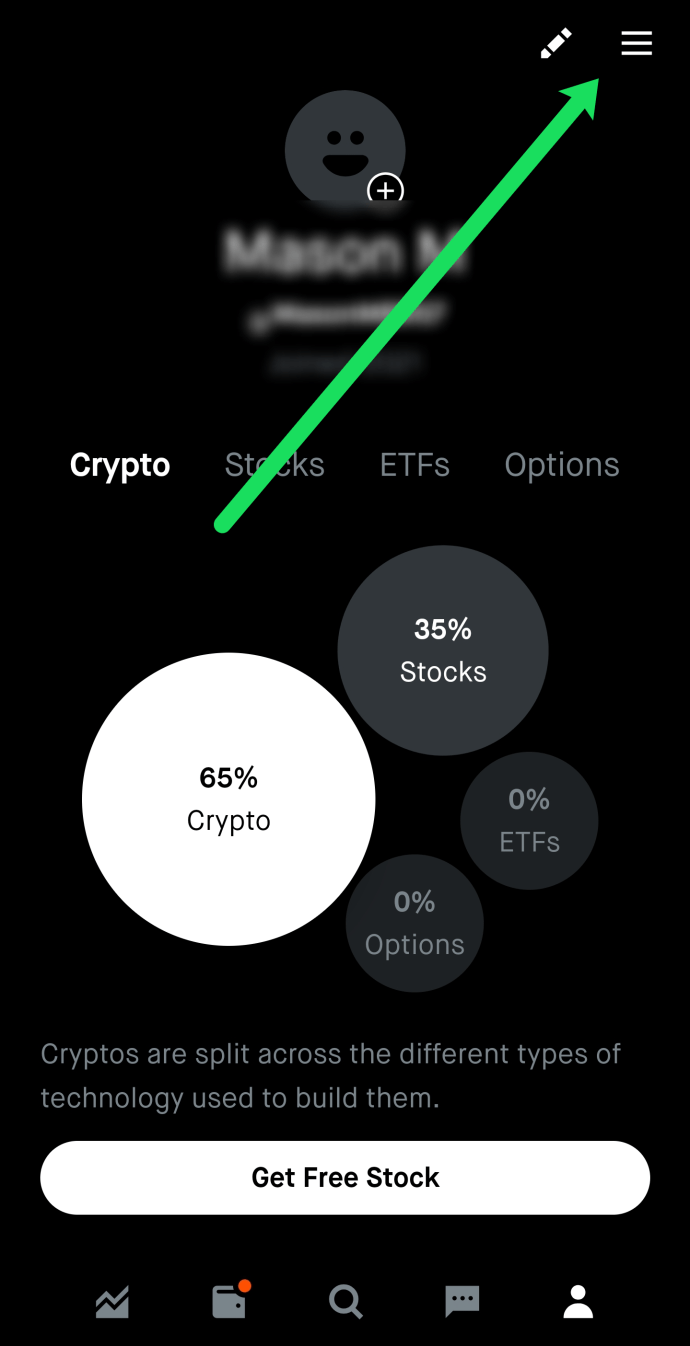

- On your screen, in the lower-right corner, click the “Account” icon.

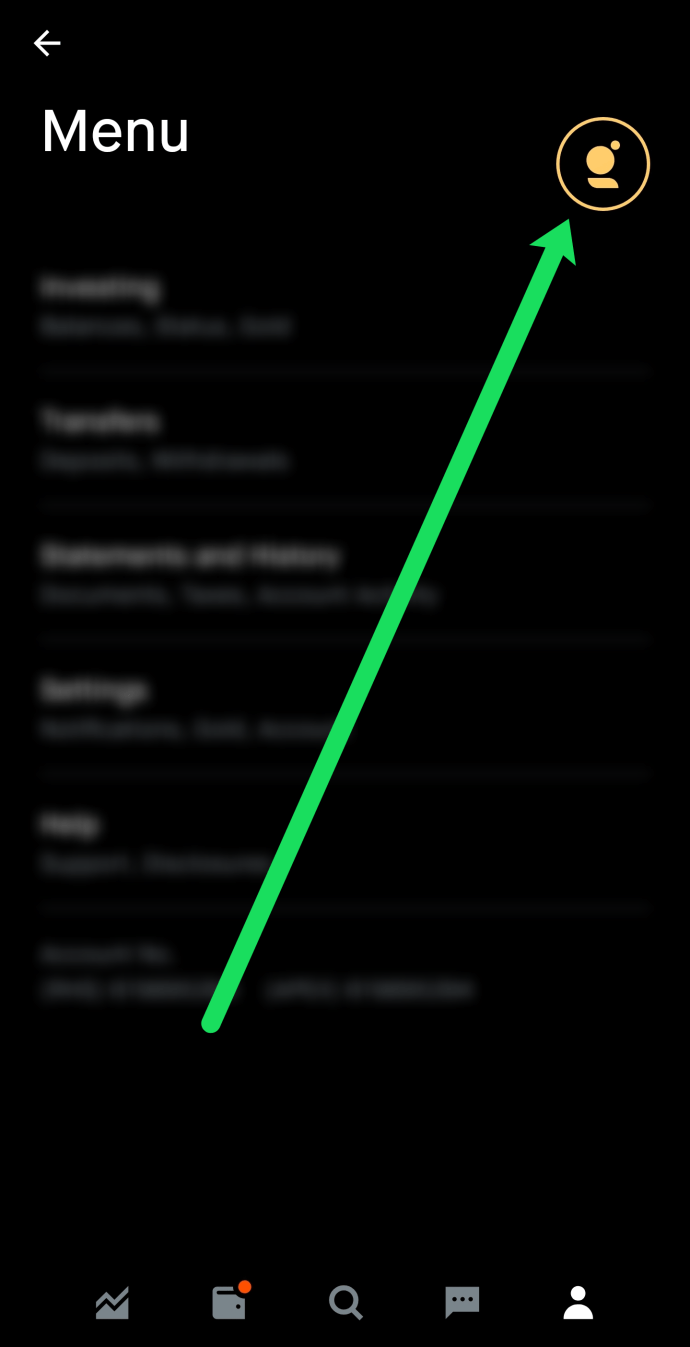

- Select “Settings” by pressing the three bars in the upper portion of your display.

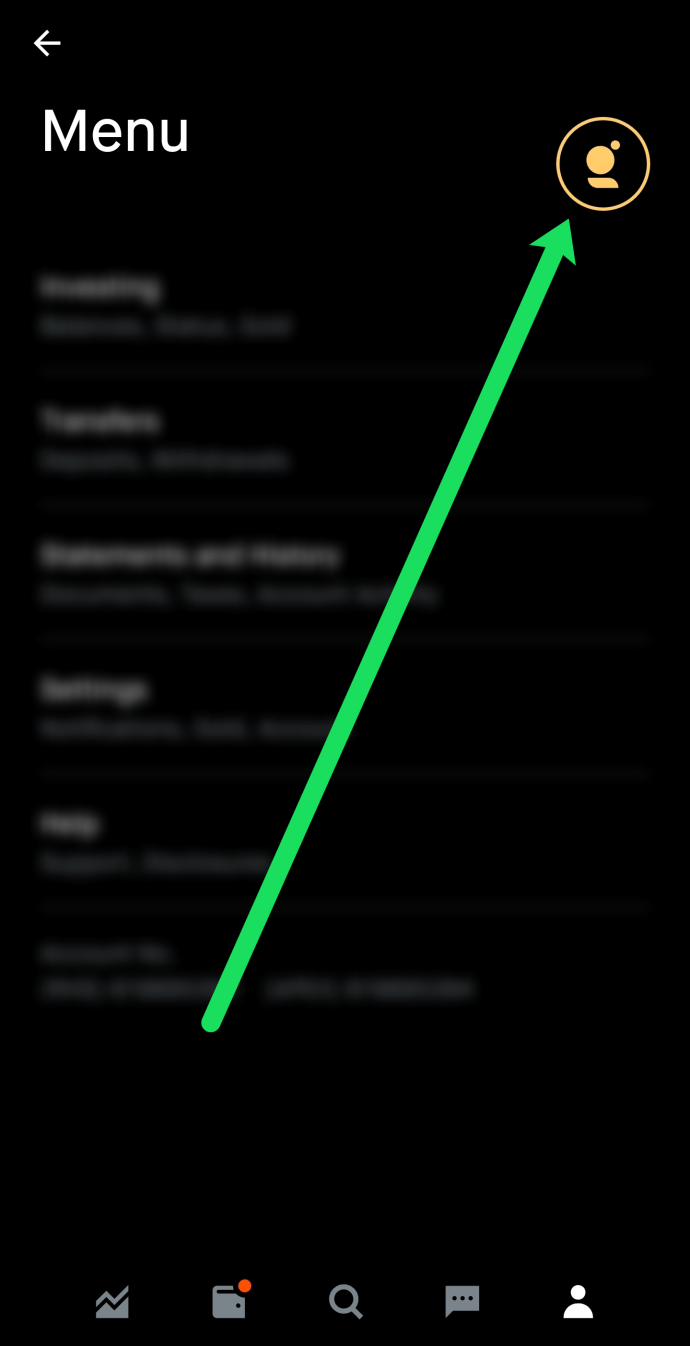

- Select “Robinhood Gold” from the menu.

The online version of the process is a little simpler:

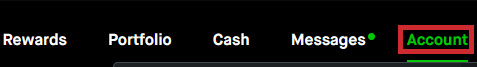

- In the top-right corner of your screen, click “Account.”

- Just click “Robinhood Gold.”

Stock Trading During Off-Hours

You can now start buying and selling stocks after hours after enabling Robinhood Gold:

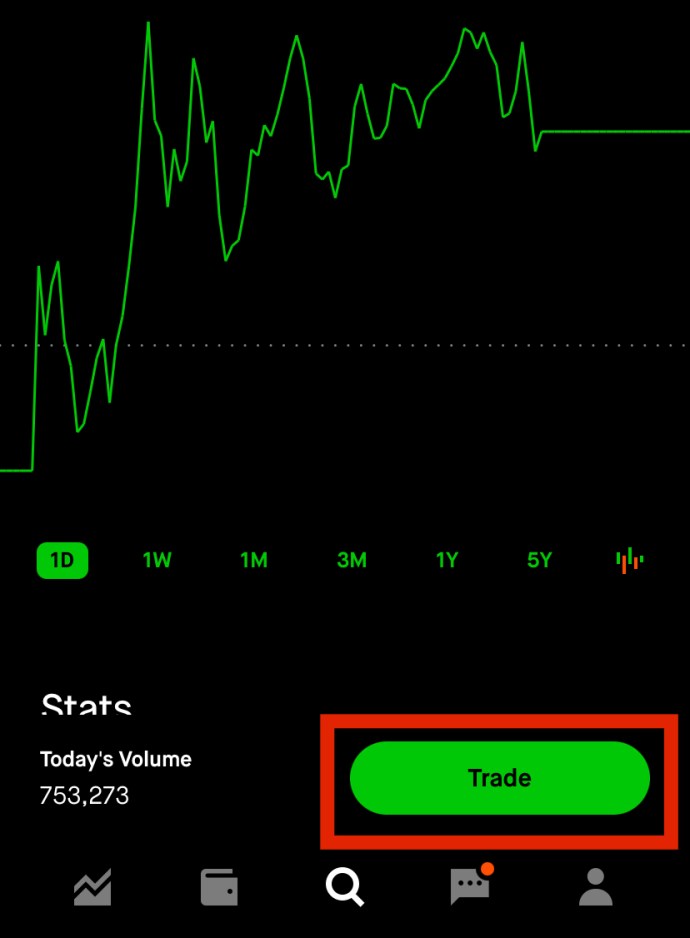

- Go to the detail page for any stock. Press the “Trade” button located in the lower-left corner of the screen.

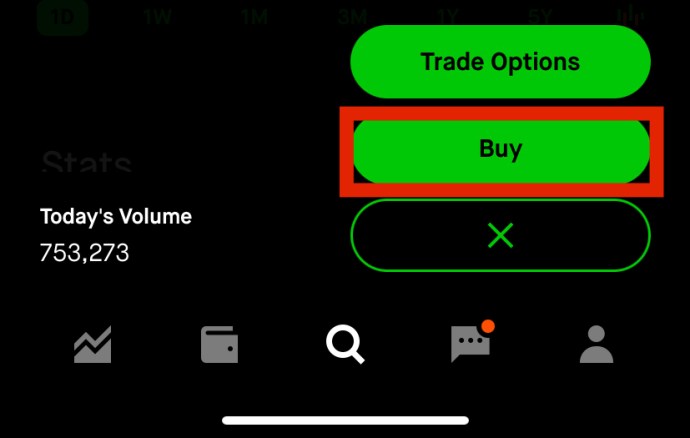

- Next, click “Sell” or “Buy.” If you haven’t already bought the stock, the “Buy” button will appear automatically.

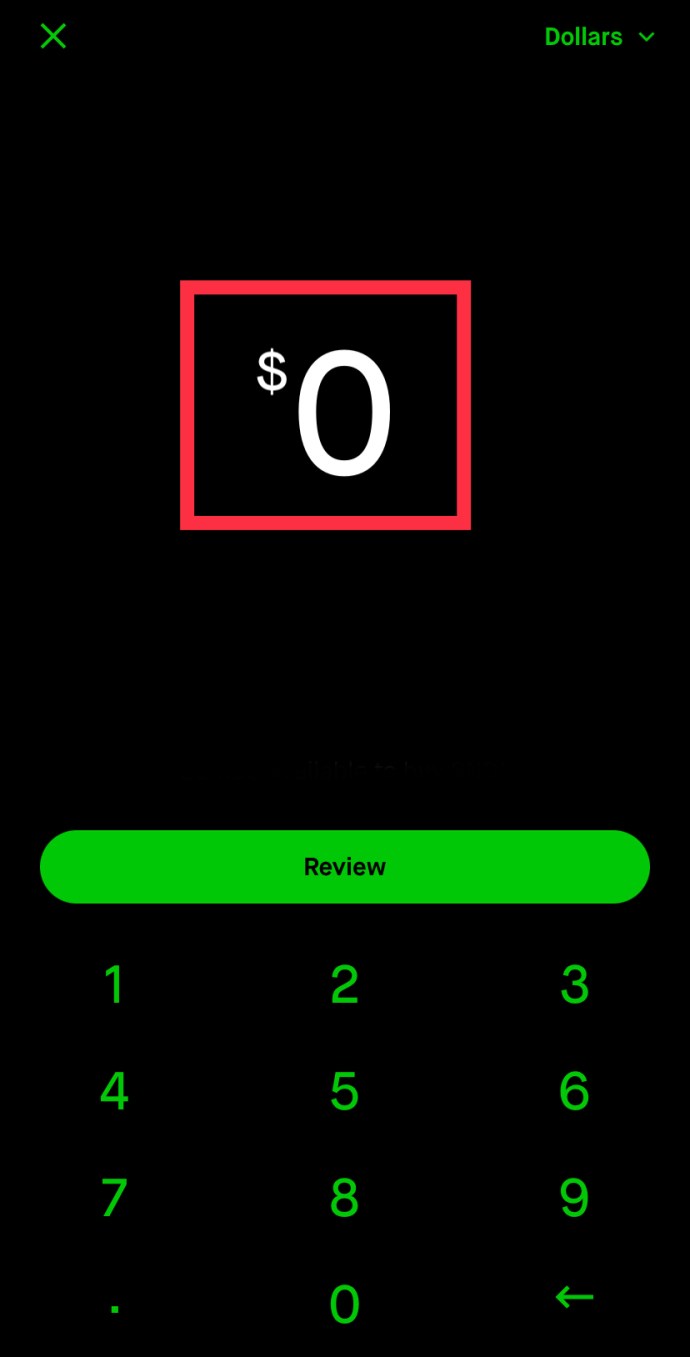

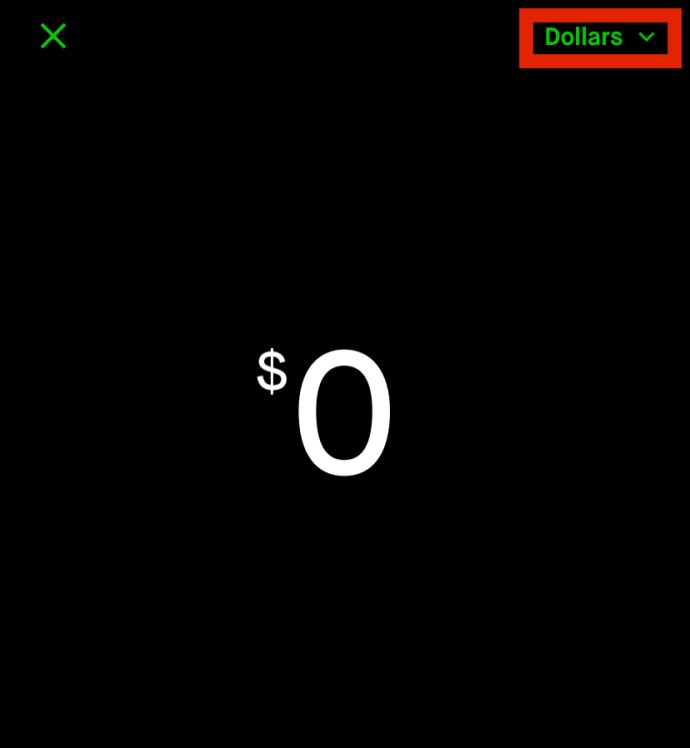

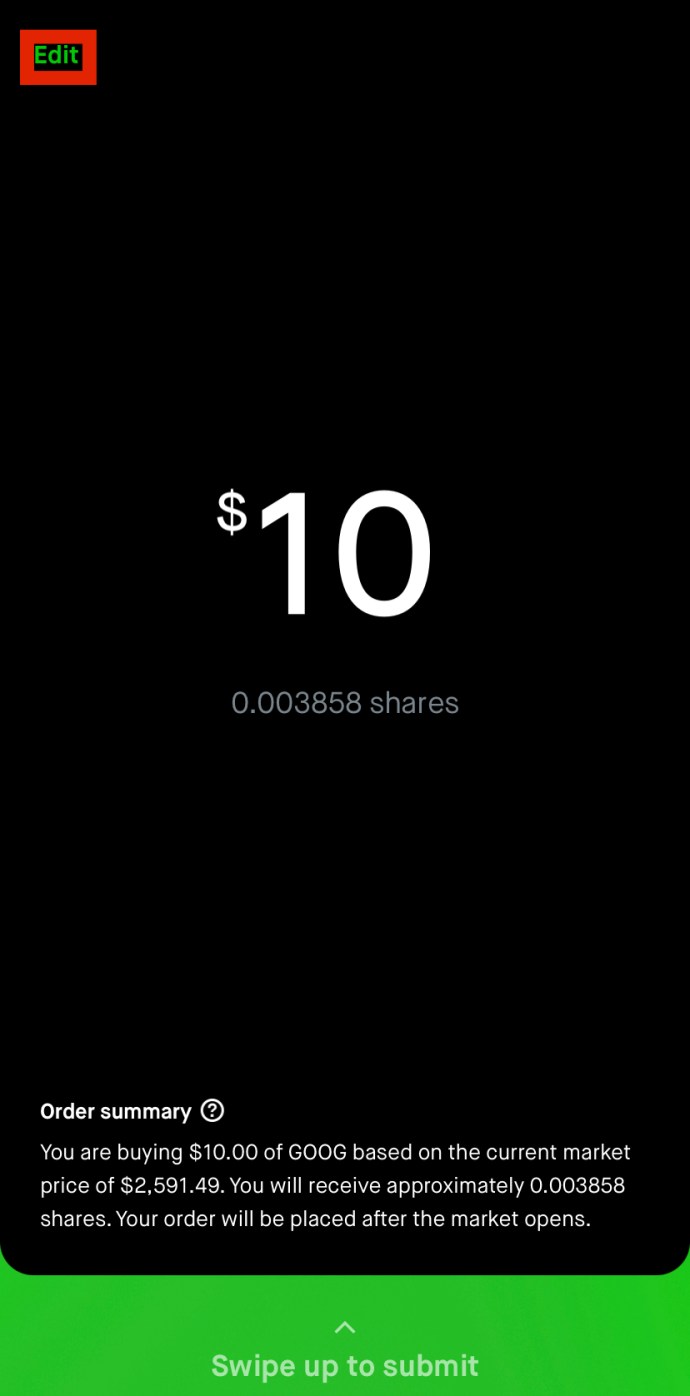

- Enter the dollar amount you want to buy or sell in the appropriate field.

- You can use the menu in the top-right corner to buy or sell shares. “Dollars” should be chosen, along with “Buy in Shares” (or “Sell in Shares” if selling).

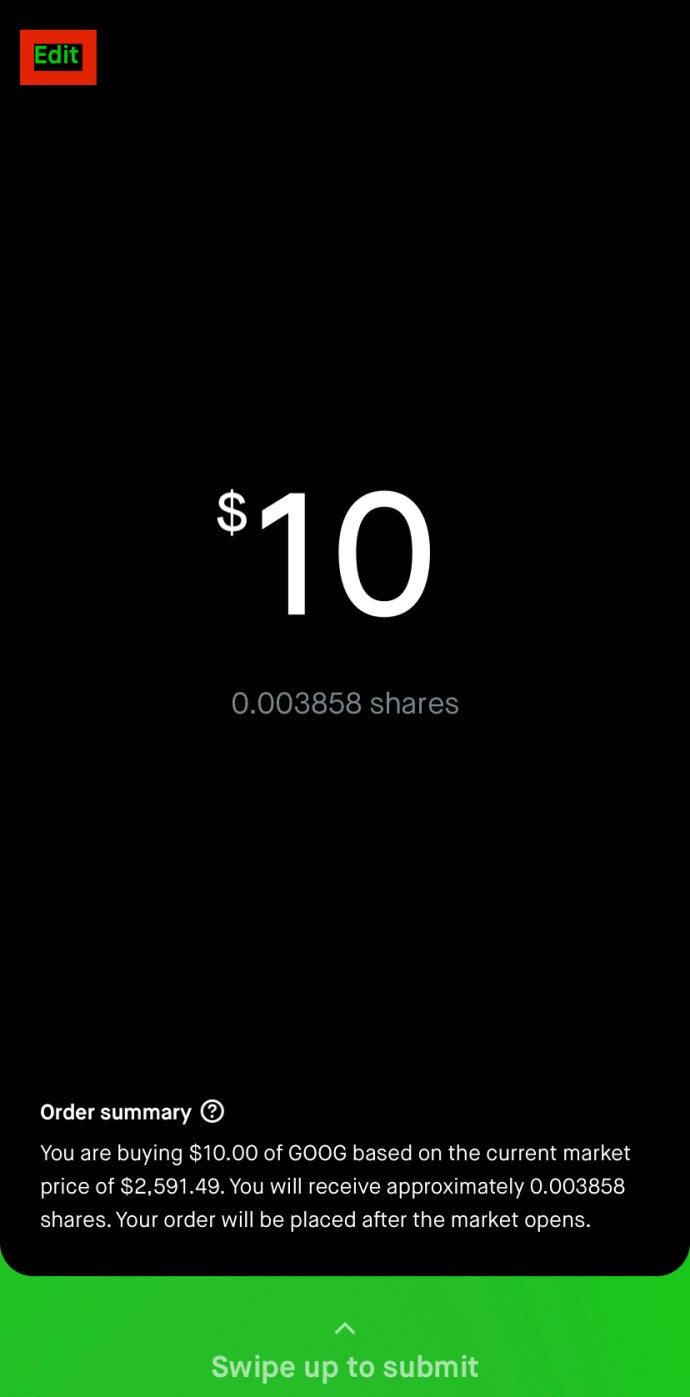

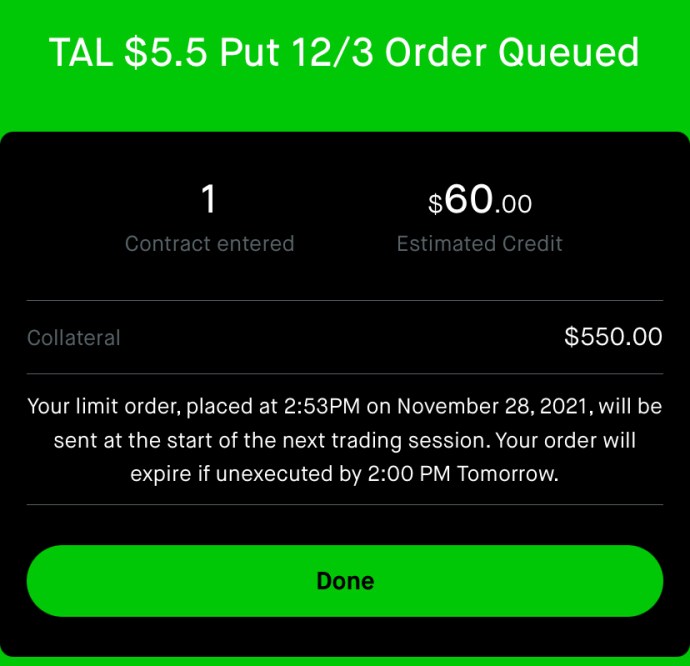

- Check the order again to be sure all of your information is accurate. If you wish to change the order, click the “Edit” button in the upper-left corner of the screen.

- Your order will be submitted when you swipe up.

FAQs

Why do Stocks After Hours Trading?

Trading on Robinhood after business hours can be profitable for a number of reasons. One of the biggest advantages is during earnings reports. After the market has closed, the company shares you own may release its quarterly financial results. As a result, prices may fluctuate more than they would during regular session times, giving you the chance to seize several possibilities.

The foreign market activity that occurs after business hours is another fantastic feature. Asian or European markets may have an impact on US market prices. After regular trading hours, activity occurs outside of the US, and extended sessions let you profit from a huge variety of companies.

Premarket and After-Hours Trading Sessions on Robinhood are held on what days?

During regular trading sessions, Robinhood markets open at 9:30 AM Eastern Time. The pre-market for Robinhood begins at 9:00 AM Eastern Time, 30 minutes before regular trading hours. The after-hours trading session takes place from 4:00 to 6:00 PM Eastern Time. You can trade for an additional two and a half hours each day when you combine it with premarket.

Market orders are available on Robinhood?

Trading in market orders is available on Robinhood. During regular and extended sessions, they are typically completed right away because of their increased priority. When they want to prevent partial fills or fast trade their stocks, the majority of investors employ market orders.

Keep in mind that market orders don’t always come with price guarantees for their owners. Your market purchasing order might be automatically changed into a limit order with a 5% collar by the software in order to safeguard it from extreme price swings. During prolonged sessions, Robinhood uses limit orders in the same way.

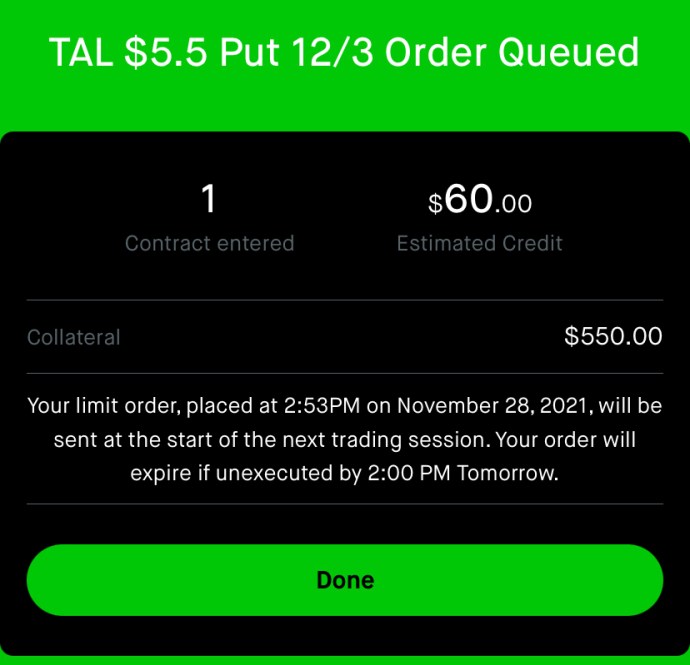

Once the nighttime trading sessions have ended, market orders placed through Robinhood will be forwarded to the morning’s regular trading sessions. A typical stop order or a trailing stop order won’t be carried out during extended-hours periods, either. Orders for stop-loss, stop-limit, and tail stops submitted during extended hours are executed when regular trading hours resume.

Offer Limit Orders on Robinhood?

Keep in mind that you can only place limit orders during the pre-market and after-hours trading sessions if you desire to do so. If the objective limit price and lot size for the stock are met, your order will then be carried out. Your market orders are instantly converted to limit orders by Robinhood, which also includes a 5% collar as protection against severe price swings.

Does Robinhood consider after-hours selling to be day trading?

The transaction will still be considered day trading for the purposes of day trading regulations if you purchase a stock during regular trading hours and sell it during the extended session the same day. Sell your shares the following day if you want to avoid day trading.

What Are the Trading Fees on Robinhood?

About This Post: blank

List: Modify the block style or type to unordered list conversion Organize as an ordered list Outlined text item Embedded list item Title added How to Buy or Sell in Robinhood After Hours

With the helpful app Robinhood, you may purchase and sell stocks without paying a commission. The software also enables after-hours trading in addition to during business hours. You can then take advantage of numerous advantages including more market activity and lower prices. You must enable this function because it isn’t immediately available. This article will go into detail on using Robinhood after hours to buy or sell.

Robinhood Gold: Buying and Selling After Hours

Trading after hours isn’t particularly difficult, but it’s only available to Gold members, so you’ll need to first increase your membership. Here’s how to sign up for the subscription on your phone, which costs $5 per month:

- On your screen, in the lower-right corner, click the “Account” icon.

- Select “Settings” by pressing the three bars in the upper portion of your display.

- Select “Robinhood Gold” from the menu.

The online version of the process is a little simpler:

- In the top-right corner of your screen, click “Account.”

- Just click “Robinhood Gold.”

Stock Trading During Off-Hours

You can now start buying and selling stocks after hours after enabling Robinhood Gold:

- Go to the detail page for any stock. Press the “Trade” button located in the lower-left corner of the screen.

- then either “Sell” or “Buy” is followed. If you haven’t already bought the stock, the “Buy” button will appear automatically.

- Enter the dollar amount you want to buy or sell in the appropriate field. You can use the menu in the top-right corner to buy or sell shares. “Dollars” should be chosen, along with “Buy in Shares” (or “Sell in Shares” if selling).

- Check the order again to be sure all of your information is accurate. If you wish to change the order, click the “Edit” button in the upper-left corner of the screen.

- Your order will be submitted when you swipe up.

FAQs

Why do Stocks After Hours Trading?

Trading on Robinhood after business hours can be profitable for a number of reasons. One of the biggest advantages is during earnings reports. After the market has closed, the company shares you own may release its quarterly financial results. As a result, prices may fluctuate more than they would during regular session times, giving you the chance to seize several possibilities.

The foreign market activity that occurs after business hours is another fantastic feature. Asian or European markets may have an impact on US market prices. After regular trading hours, activity occurs outside of the US, and extended sessions let you profit from a huge variety of companies.

Premarket and After-Hours Trading Sessions on Robinhood are held on what days?

During regular trading sessions, Robinhood markets open at 9:30 AM Eastern Time. The pre-market for Robinhood begins at 9:00 AM Eastern Time, 30 minutes before regular trading hours. The after-hours trading session takes place from 4:00 to 6:00 PM Eastern Time. You can trade for an additional two and a half hours each day when you combine it with premarket.

Market orders are available on Robinhood?

Trading in market orders is available on Robinhood. During regular and extended sessions, they are typically completed right away because of their increased priority. When they want to prevent partial fills or fast trade their stocks, the majority of investors employ market orders.

Keep in mind that market orders don’t always come with price guarantees for their owners. Your market purchasing order might be automatically changed into a limit order with a 5% collar by the software in order to safeguard it from extreme price swings. During prolonged sessions, Robinhood uses limit orders in the same way.

Once the nighttime trading sessions have ended, market orders placed through Robinhood will be forwarded to the morning’s regular trading sessions. A typical stop order or a trailing stop order won’t be carried out during extended-hours periods, either. Orders for stop-loss, stop-limit, and tail stops submitted during extended hours are executed when regular trading hours resume.

Offer Limit Orders on Robinhood?

Keep in mind that you can only place limit orders during the pre-market and after-hours trading sessions if you desire to do so. If the objective limit price and lot size for the stock are met, your order will then be carried out. Your market orders are instantly converted to limit orders by Robinhood, which also includes a 5% collar as protection against severe price swings.

Does Robinhood consider after-hours selling to be day trading?

The transaction will still be considered day trading for the purposes of day trading regulations if you purchase a stock during regular trading hours and sell it during the extended session the same day. Sell your shares the following day if you want to avoid day trading.

What Are the Trading Fees on Robinhood?

On Robinhood, there are no trading costs. While many other app functions are free as well, some do have a cost. Here is a quick summary:

• There is no commission applied to any equity trading.

• There are no per-contact or per-leg costs associated with trading options.

• To trade on margin with $1,000 of margin, you need a Gold subscription. A 5% interest charge will apply if you desire to exceed the limit.

• The $75 account transfer fee is currently in effect.

• There is no price for the assignment and workout.

• Overnight delivery of domestic checks is $35.

The cost of live broker services is $10 per transaction.

• Domestic wire transfers cost $25, while international wire transfers cost $50. Generally, there is no charge for receiving a wire.

Improve Your Investing Skills

Don’t limit your purchases or sales on Robinhood to the standard trading hours. You now understand how to fully profit from extended sessions, which have several advantages. Make sure to renew your premium membership to maintain access to this wonderful feature once your 30-day free Gold subscription trial has expired. Make your investments after that in the same manner as you would during regular market hours.

Have you tried trading on Robinhood after hours? Did you succeed in grabbing some fantastic opportunities? Do you intend to keep your Gold membership? Comment below with your thoughts and let us know. Devices

Revised Checklist

How to Buy or Sell on Robinhood After Hours (h1)

What Time Does Trading Start on Robinhood?

h1: Instructions for Placing Orders on Robinhood After Hours

Why You Would Trade Stocks After Hours (h1)

h1: Further FAQs

Does Day Trading on Robinhood Apply to After-Hours Sales?

When Am I Able to Trade on Robinhood?

What Are the Trading Fees for Robinhood?

What Are the Pre-Market Trading Hours for Robinhood?

Robinhood: Is it a Market Order?

Can You Buy Stocks on Robinhood After the Market Closes?

h2: TD Ameritrade Pre Market Trading Instructions

Verification of Information Styling (h2s and h3s) Review suggested headings Screenshots Schema (if applicable) Note: Verify Categories (History) The last update was at 2021-07-11 18:34:04. -reduced fluff, condensed layout, and deleted redundant and irrelevant material. additional screenshots

List

Make a list using bullets or numbers.

The size of the font

Custom

Start price

List numbering in reverse

On Robinhood, there are no trading costs. While many other app functions are free as well, some do have a cost. Here is a quick summary:

• There is no commission applied to any equity trading.

• There are no per-contact or per-leg costs associated with trading options.

• To trade on margin with $1,000 of margin, you need a Gold subscription. A 5% interest charge will apply if you desire to exceed the limit.

• The $75 account transfer fee is currently in effect.

• There is no price for the assignment and workout.

• Overnight delivery of domestic checks is $35.

The cost of live broker services is $10 per transaction.

• Domestic wire transfers cost $25, while international wire transfers cost $50. Generally, there is no charge for receiving a wire.

Improve Your Investing Skills

Don’t limit your purchases or sales on Robinhood to the standard trading hours. You now understand how to fully profit from extended sessions, which have several advantages. Make sure to renew your premium membership to maintain access to this wonderful feature once your 30-day free Gold subscription trial has expired. Make your investments after that in the same manner as you would during regular market hours.

Have you tried trading on Robinhood after hours? Did you succeed in grabbing some fantastic opportunities? Do you intend to keep your Gold membership? Comment below with your thoughts and let us know.