Several banks in the United States, including Wells Fargo, support the transaction service called Zelle. It enables users to transfer and receive money without going to a physical place owned by a third party. The transfers take place quickly, making it simple to give money to a friend who just paid a restaurant bill or assist a relative in need.

Transaction Cap for Other Banks and Wells Fargo

A handy way to conduct transactions is using Zelle. This is why a lot of people choose it as a method of payment. For instance, you might have to send money to a relative so they can pay their bills. Having said that, how much money can you send someone every day in total?

In general, Zelle restricts customers to sending up to $5,000 each month, or around $1,000 per week. Check your bank’s sending limit because it differs from bank to bank. The daily and monthly limits for Wells Fargo customers are $2,500 and $20,000 respectively.

However, according to Wells Fargo, depending on the duration of a user’s account or the source of funding, they may reduce or increase this sum. When sending bigger sums of money, it is preferable to speak with Wells Fargo in person and find out what the bank’s maximum transaction limit is.

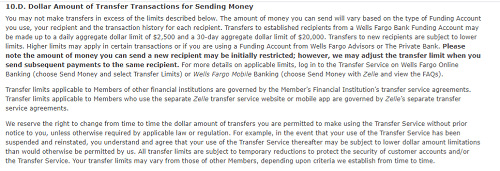

Remember that Wells Fargo reserves the right to modify this amount at any time. Because of this, it’s critical to visit their website for the most recent information. You should bookmark this link. The maximum amount that Wells Fargo allows its customers to send using Zelle is listed under Section D.

the Wells Fargo Zelle Limit

The limit applies to both Bank of America and Wells Fargo customers. For both individual clients and commercial clients, Chase has various limits. A private account has a daily restriction of $2,000 and a monthly cap of $16,000. Businesses can pay $5,000 per day or $40,000 per month.

What Happens If My Bank Isn’t Using Zelle?

Every day, more banks join Zelle’s partnership program. There aren’t many steps you need to take if your bank cooperates with them. Using a smartphone app or your bank’s online account, you can send money to someone else.

But what if Zelle and your bank are not affiliated? Can you still use this site to send money? Yes is the quickest response. Simply download the app, which is accessible to Android and iOS . After that, you can begin sending money by linking your credit card.

How to Conduct Business

If you’re new to Zelle and would like to make a payment, follow these instructions:

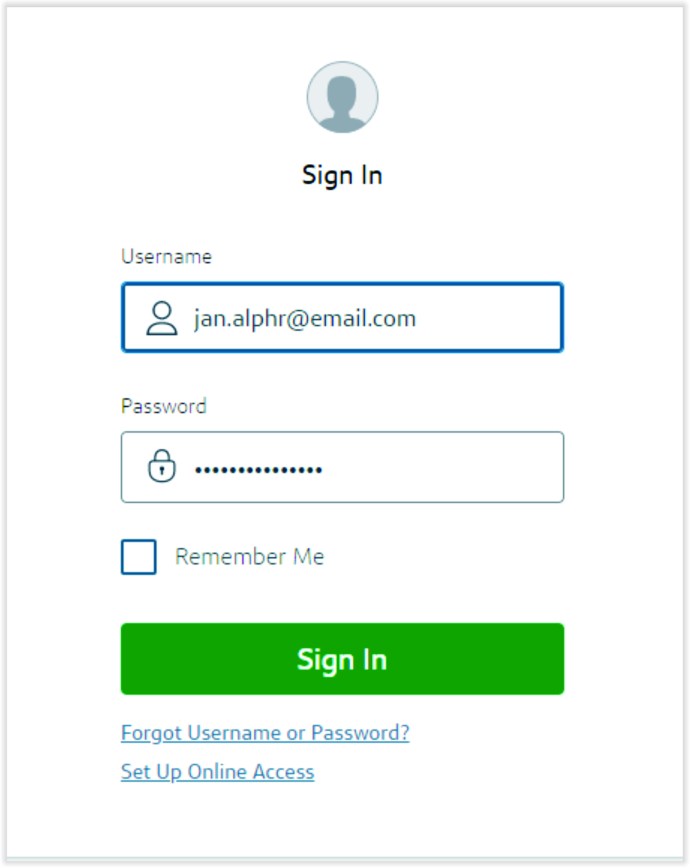

- Launch the mobile app for your bank or go to the bank’s website to log in to your account. Each bank has a unique system.

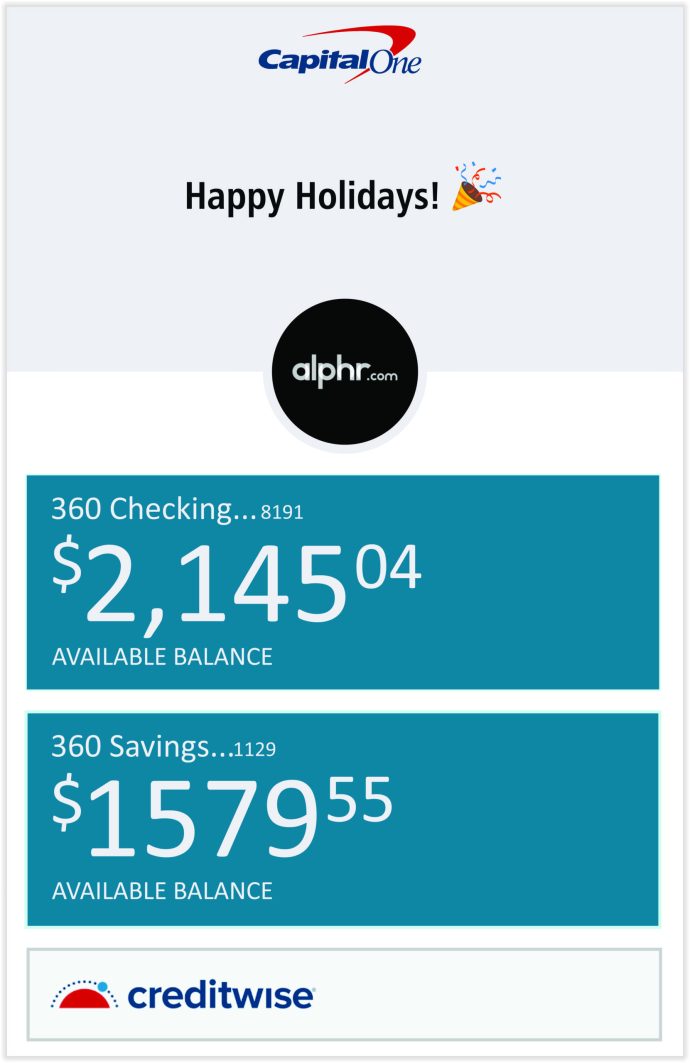

- You can see how much money is in your account after you launch the app.

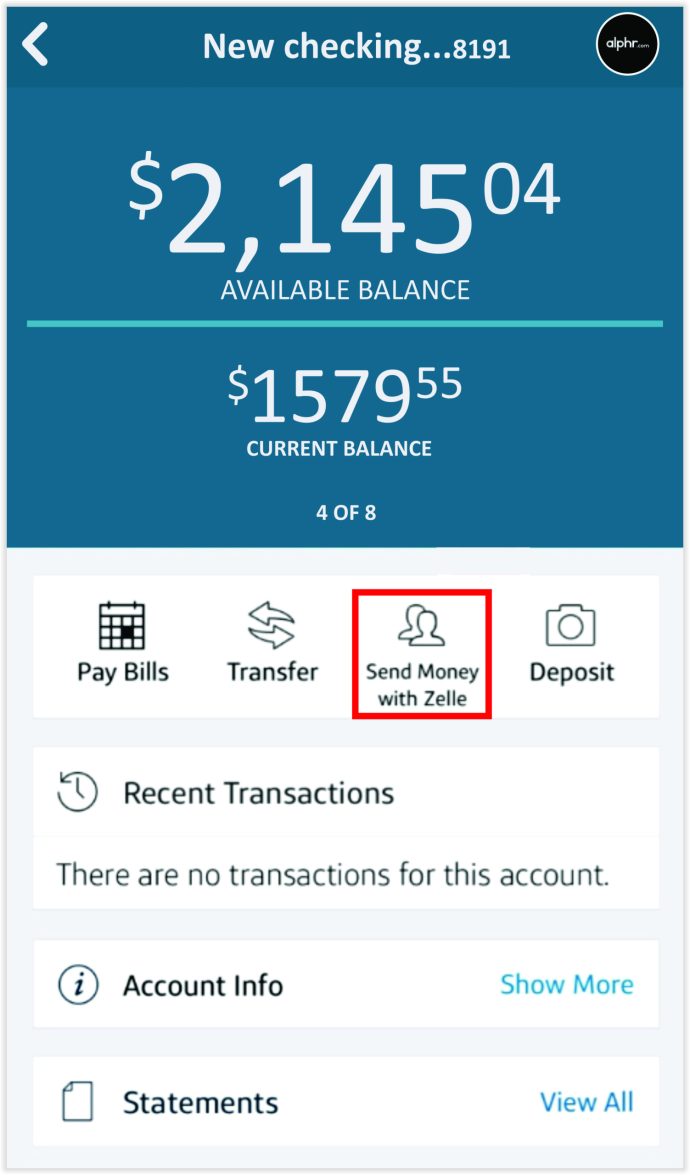

- Send Money with Zelle will be displayed. Tap on Send Money to send a payment.

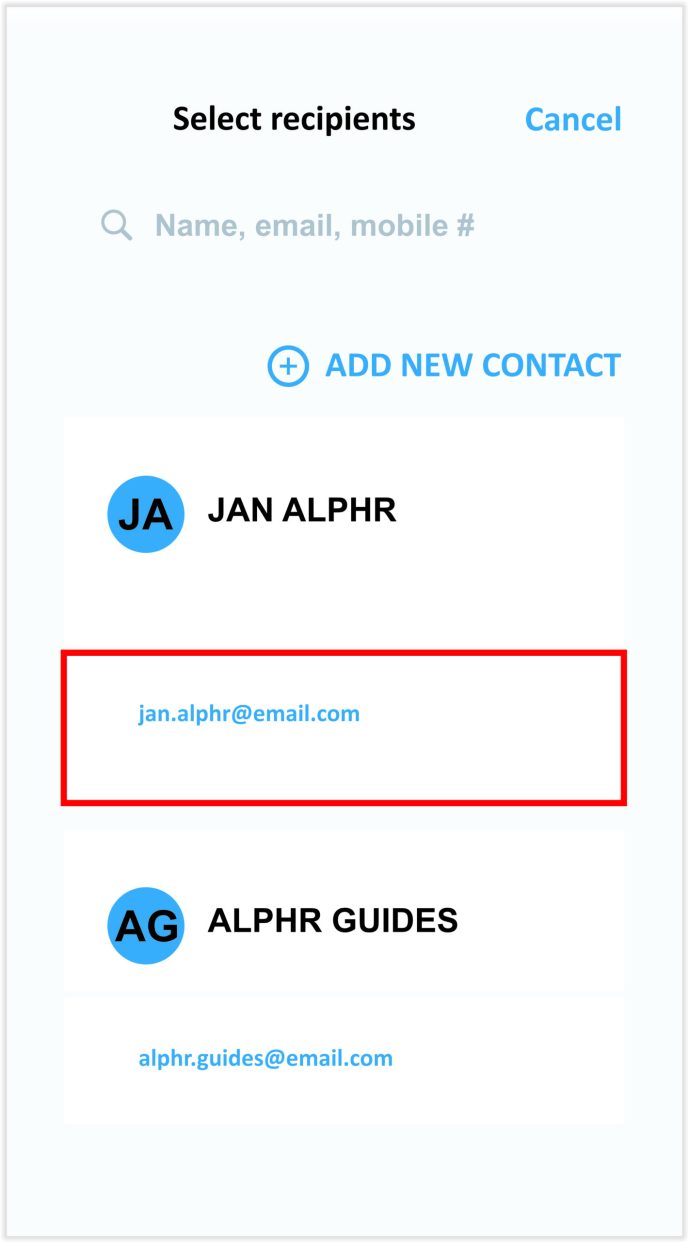

- By doing this, the list of your past receivers and your phone’s contacts will open. Simply tap on the individual on your list if they are the one who needs to be given money. If not, enter the recipient’s email address and phone number in the search box.

What Is the Wells Fargo Zelle Limit?

Once everything is written, decide how much money you wish to send. Press Preview to view the transaction’s specifics. Additionally, if you want a reminder, you can write down the rationale for the payment. To complete the transaction, use the Slide to Send button. A pop-up notification will ask you to verify that you are sending money to the correct recipient. Click Yes to finish if everything is in order. The money will be given to the person in a matter of seconds.

The Benefits of Using Zelle

Convenience is one of the main factors contributing to customers choosing Zelle over other money transfer services. Making transactions is simple and quick. For instance, if a relative needs money right away, they can enter right away. If the person needs money for an emergency, it may take days for these transactions to complete with other apps of a similar nature.

And unlike other apps of this type, there are no costs associated with making or receiving funds. Similar apps typically charge certain fees for completed transactions.

And finally, a lot of landlords now accept Zelle payments. As a result, you can send money to someone fast and easily even if they don’t live in the same city as you and without incurring any additional fees.

Transactions with Zelle

Payments can be made with Zelle quickly and easily. Every day, more people use it thanks to its quickness, fees-free nature, and ease. Additionally, more institutions are collaborating with Zelle to facilitate money transfers for their clients. The bank determines the daily and monthly transaction caps. As a result, be sure to ask your bank what the maximum you can send is.

Who are you? Frequently do you use Zelle? What do you consider to be its main benefit? Comment below with your thoughts and let us know.