Best Apps Like Solo Funds & Similar Apps

You definitely don’t want to accumulate debt. However, certain circumstances can compel you to take part in it. Although the Solo Funds app is fantastic and fairly well-liked, did you know that there are other applications that could provide you with more options?

People still turn to traditional lenders first if they require finance. However, not everyone can afford that choice. Most of the time, a person’s credit score makes it challenging to follow the conventional route.

You may learn more about other money-lending applications in this article besides Solo Funds. Your smartphone can access anything, which is fantastic and ensures a quick process.

Best Solo Funds-like Apps for iOS and Android

Are you familiar with Solo Funds? Users of this app can utilise its services to apply for loans and funding. Therefore, you can ask Solo Funds for a cash advance if you encounter an emergency. Although there are restrictions and conditions, this app is legitimate and has processed a lot of transactions since 2018.

Using a peer-to-peer lending company may be the best option depending on your viewpoint. Solo Funds and other such applications may be able to give you what you need without the trouble, provided you choose the appropriate one.

So, here are a few apps you should check at if you’re seeking for a service that assists you with financial difficulties.

1. MoneyLion

Are the top Solo Funds alternatives on your list? If so, MoneyLion is just what you require. Both the Play Store and the App Store both have this app. You should think about using this app, especially for easy loans with cheap interest rates.

Users of this platform claim that MoneyLion enables borrowing of up to $1,000 USD. Later, you can at least repay it within a year. Initially, this platform might perform a credit check. If you have membership, though, you can omit it.

Despite its advantages, MoneyLion only provides tiny loans. In addition, the system might deduct money from your salary to repay the debt. However, if you initially require a loan without a credit check, this app is one that you might think about.

Download on Google Play Download on the App Store

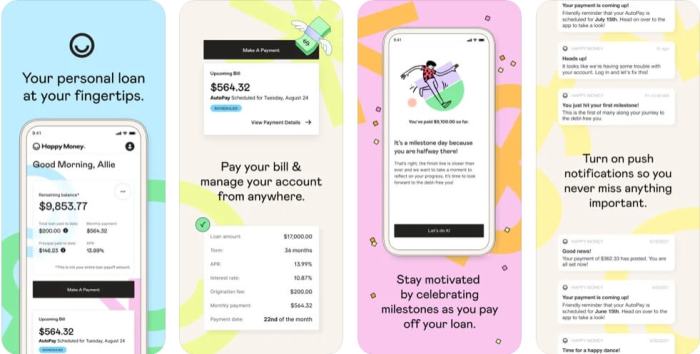

2. Happy Money

A lend and borrow money app can be found today in a wide variety of forms. The Happy Money app is one of such. This platform was formerly known as Payoff, but you can now find it online as Happy Money.

This website offers help for managing credit card debt. You can get a fast credit decision and a cheaper APR by utilising our app. In addition, you can use this software to improve your credit. Many people adore Happy Money for a variety of reasons, including:

- There is no fine for late fees.

- Free newsletters provide financial tips.

- Three major credit bureaus keep records of all report payments.

- The due date is modifiable.

- Additionally, you have the option of paying the investors directly.

The autopay date can be chosen, however there is no rate discount or any exclusive promotion. You cannot sign the loan as a co-signer other than that.

Download on Google Play Download on the App Store

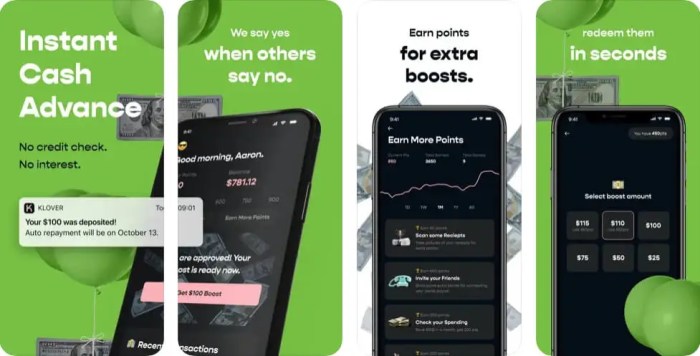

3. Klover

One of the apps like Klover that will give you a loan is often Solo Fund. But what exactly is Klover? Is it genuine?

Klover is an app for financial advances. As its name implies, you may receive your salary before payday. So, if you experience a financial emergency, this app could be able to help.

There has been Klover for a while. Because there are no additional costs, people adore utilising this software. If you are a member, the money will, aside from that, be in your account in a matter of minutes. But if you take use of the complimentary services, the money can appear in two days.

More than anything else, Klover is an excellent platform to take into account, especially if you have credit score issues. You must, however, pay back the loan before the deadline. This platform provides a somewhat low credit limit in comparison to other apps of a similar nature.

Download on Google Play Download on the App Store

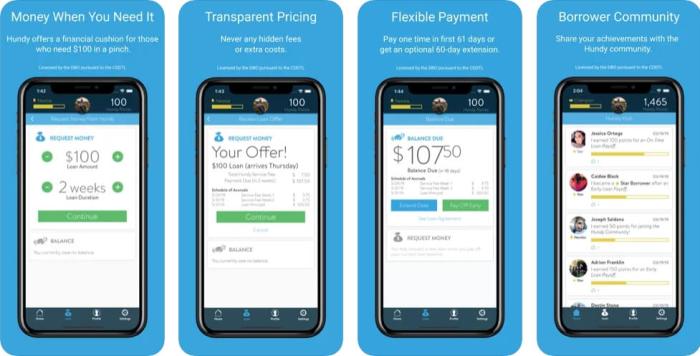

4. Hundy

Do you know what Vola Finance is? Well, Hundy is one of the apps that functions similarly to Solo Funds and Vola Finance. This software lets you communicate with investors. Whether you need money for rent or groceries, Hundy will assist you in making decisions.

Compared to the other apps on this list, this app is more popular with users. Here are a few of them:

- a simple user interface.

- Early repayment is not subject to any penalties.

- There are no penalties or monthly fees associated with your borrowing plan.

But Hundy demands that the borrowers maintain a consistent deposit in their accounts. After all, those instalments ought to be made consistently. However, this app is one that you should think about using for a loan. Hundy is now only accessible to iOS users.

5. LendingClub

Payday loan applications, which let users acquire cash advances and quickly repay them, are preferred by certain people. However, LendingClub is what you require if you wish to receive a better sum with a longer period for repaying the loan.

This p2p app enables you to expand your business. Of course, individuals who don’t want to engage with conventional institutions should give this platform serious thought. LendClub manages credit cards, mortgages, personal loans, student loans, in addition to making loans.

LendingClub is adored by people for a number of reasons, including

- If you want greater possibilities, you can sign a co-borrower.

- There isn’t a formal credit check.

- You can choose a payback period of three to five years with LendingClub.

But this application will perform a credit check. In order to be approved for the loan, your score must be at least 600. If it’s not possible, you can sign a co-borrower to raise your credit score in the interim.

Download on Google Play Download on the App Store

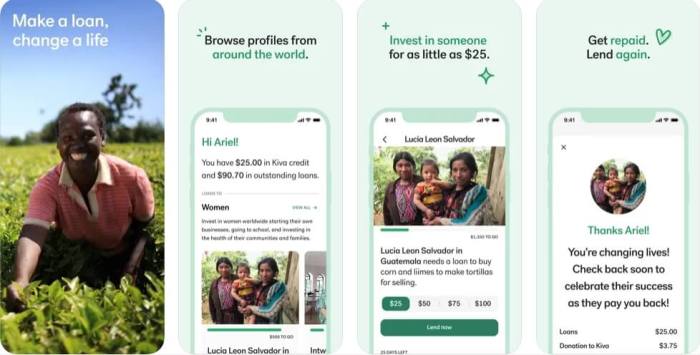

6. Kiva

.

Do you know about Kiva? Anyone can borrow money online with this software. The Kiva app is always prepared to provide you with extra cash, whether you are a student or an entrepreneur. Currently, 77 nations around the world can access the app.

Your personal story must be shared with Kiva in order for the lender to relate to you. This platform’s objective is to offer a secure setting where many users can borrow money. Of course, the app gives you access to everything.

This app is superior to others in a number of ways, including:

- The payment of origination fees is not necessary.

- Initially, Kiva won’t perform a credit check.

- Payment terms are very flexible.

However, some users claim that Kiva only lends money to fledgling businesses. The application procedure takes longer than other apps on this list aside from that. Nevertheless, you should think about using this app rather than visiting a bank or other conventional organisations.

Download on Google Play Download on the App Store

7. Prosper

Do you want the greatest peer-to-peer lending? If so, you ought to look into Prosper. For investors, this site is a fantastic option. Despite the fact that Prosper only accepts credit scores up to 640, it offers a wide range of loan sizes.

On the other side, you can enhance your credit score by adding a co-borrower. In addition, Prosper offers speedy loan distribution, a characteristic that is uncommon on other platforms that are similar to it. Prosper offers a number of tools to manage your finances in addition to letting you apply for loans.

Other elements that users adore about this peer-to-peer lending app include:

- The potential gains are substantial.

- The initial investment is $25 USD.

- Because the payments can arrive in as little as three days, be careful to check your account.

- There is no fee for early repayment.

Prosper will provide you up to USD40,000 – limits and limitations apply, according to users of this platform. The fact that you won’t have to cope with a hefty interest rate is wonderful news.

Download on Google Play Download on the App Store

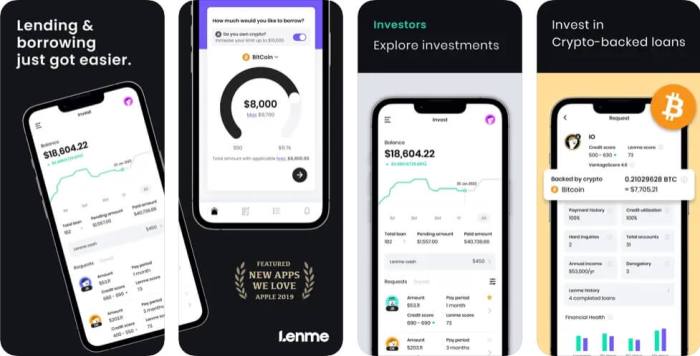

8. LenMe

LenMe might look familiar if you’ve used Solo Funds and are looking for apps that are comparable. You can borrow money using this site without having to deal with the inconvenience of applying for loans from banks.

Because there are no fees for teaming up, maintaining employees, or other costs that can arise from additional services, the cost is far lower than that of typical banks. Other than that, you are exempt from going through the difficult screening and verification process.

This app is adored by users because

- There are no unstated costs.

- With a reasonably low interest rate, you can borrow money.

- LenMe has a variety of loan limitations available.

- The smallest amount you may borrow is $50 USD.

LenMe is worth a try even if some people think it doesn’t give clear information on cost and security. Therefore, LenMe is what you need if you’re seeking for a loan app that would give you a loan fast.

Download on Google Play Download on the App Store

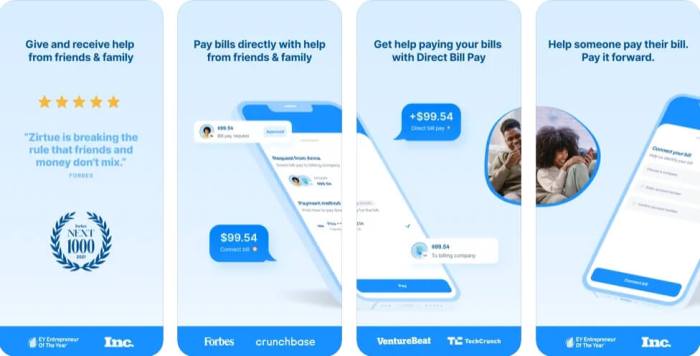

9. Zirtue

One of the top peer-to-peer loan systems you should take into consideration is the Zirtue app. This app differs from others in part because it can help you get in touch with friends and family. Later, you can use a platform to ask people to lend you money.

As this app is merely a platform, you are not required to pay interest until instructed to do so by the lender. Zirtue has collaborated with a number of banks globally up until this point. As a result, you can use the app to access all of the services.

In addition, your friend can send you money without using a bank by using Zirtue. While there is no cost to the lenders, there are monthly fees that the borrowers must pay. However, you should think about using this app, particularly if you favour asking your friends and relatives rather than other conventional banks.

Download on Google Play Download on the App Store

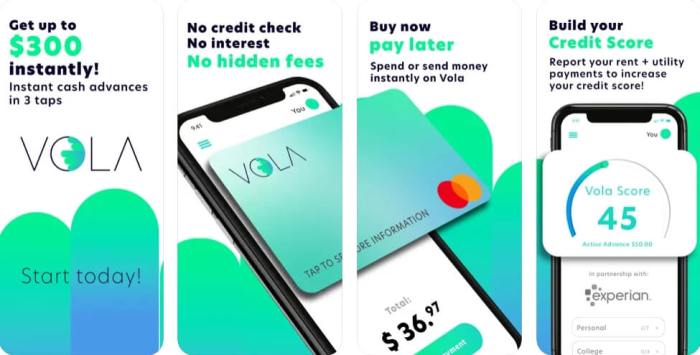

10. Vola Finance

If you’ve been using Solo Funds, you might be familiar with Albert-type apps as well. In the interim, Vola Finance is a name you should take into consideration if all you require is a cash advance platform that enables you to lend additional funds.

This app, one of the platforms for cash advances, promises immediate cash even before your payday. The only thing left to do is link your bank account. You can withdraw up to $300 in quick cash if the system confirms it, before your next paycheck arrives.

Of course, a credit check is not necessary. You are not need to deal with interest rates in addition to that. You don’t have to allow the funds to deposit immediately into your bank account. You can ask Vola for access to a virtual card in this situation. This virtual card can be used to make purchases just like regular cards.

Download on Google Play Download on the App Store

11. Albert

There may be a ton of Android apps like Solo Funds available. Albert is a good option to try if you’re seeking for someone who offers crypto services. This software is the ideal platform for investing and savings.

In addition, this platform allows you to set up a lending account. You could say Albert is the ideal location for your financial records. Albert has minimal prices for all the services compared to other applications that are similar.

If you decide to start investing through this app, a real advisor will provide you with guidance based on your investment preferences. Additionally, there are no fees associated with using Albert for investment.

You won’t find any apps that offer genuine money without investment if you search for them. Albert is a great option, though, if you require a platform that supports you via investments.

Download on Google Play Download on the App Store

For people who don’t want to go through screenings from traditional lenders, using a peer-to-peer lending network is an option. There will undoubtedly be a number of procedures to go through. But it will be worthwhile to try.

That’s all there is to it; choose one of the above-mentioned apps, such as Solo Funds, to assist you. You should weigh the advantages and disadvantages of each option and make sure that it meets your needs before making a decision.